News

5 Things I’ve Learned from a Serial Networker

Improve your networking skills and learn to use them effectively.

5 Things I’ve Learned from a Serial Networker

Improve your networking skills and learn to use them effectively.

The Tribeca TV Festival Celebrates Ten Years of...

The 2nd Tribeca TV Festival celebrates those television pioneers who have broken boundaries in episodic storytelling; when it comes to nonfiction, there is no better example of this achievement and...

The Tribeca TV Festival Celebrates Ten Years of...

The 2nd Tribeca TV Festival celebrates those television pioneers who have broken boundaries in episodic storytelling; when it comes to nonfiction, there is no better example of this achievement and...

CREATION

“A journey of a million miles begins with a single inch.” Or something like that. The quote, or the original which mine references, may be the most quoted and least...

CREATION

“A journey of a million miles begins with a single inch.” Or something like that. The quote, or the original which mine references, may be the most quoted and least...

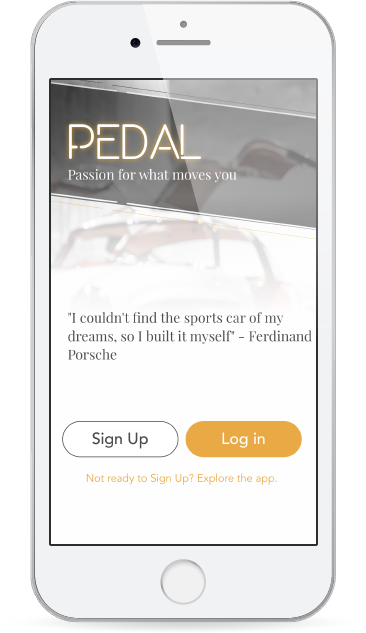

Pedal App Drives Auto Enthusiasts To The Right ...

CARS! CARS! Inc. has unveiled its new app, PEDAL, a social media community for auto enthusiasts. It’s a share space for car passion, but it’s also a place to build...

Pedal App Drives Auto Enthusiasts To The Right ...

CARS! CARS! Inc. has unveiled its new app, PEDAL, a social media community for auto enthusiasts. It’s a share space for car passion, but it’s also a place to build...

Gosselaar Powersports Gets You On The Road To S...

“If you have a passion, seek something out where you can involve that passion,”

Gosselaar Powersports Gets You On The Road To S...

“If you have a passion, seek something out where you can involve that passion,”

Consumer Health Entrepreneur Ashley Dombrowski ...

According to Ashley Dombrowski, PhD, “before” is better than “after.” The former chief business officer of 23andMe is now addressing an idea that reflects her passion -- and uses her...

Consumer Health Entrepreneur Ashley Dombrowski ...

According to Ashley Dombrowski, PhD, “before” is better than “after.” The former chief business officer of 23andMe is now addressing an idea that reflects her passion -- and uses her...